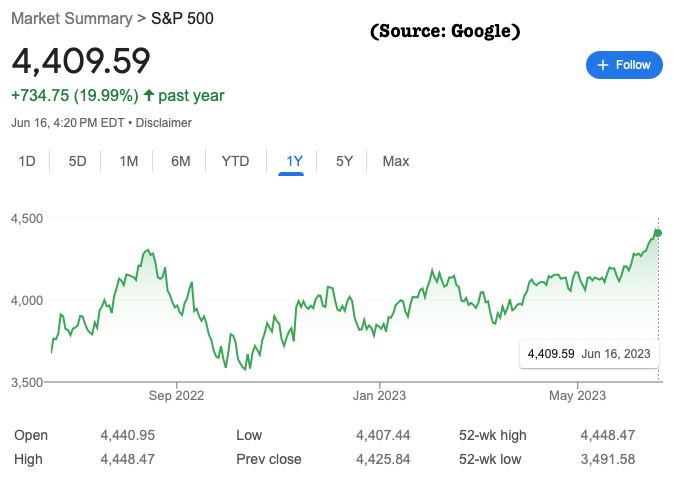

Given in the recent upward trajectory of the market, are we now in a bull market? Or is it a mirage, an illusive uptick before the next plunge, a so-called “bear market rally”?

Who knows? Time will tell.

All I know is what has happened, not what will happen. And what has happened is that recently prices have gone up, to the point that the S&P is now higher than it has been in the past year. Yes, that means balances have gone up too, and that is enjoyable to watch, especially after the back-and-forth “sideways” market of the last year or so.

Well, it is mostly enjoyable to watch. I admit, I do love buying on the cheap. As the market rises, new shares become more expensive. Yet it also feels good to see our balances rise.

How to solve this conundrum?

At the end of the day, it doesn’t matter what I think about where the market has gone or will go. I’m just along for the ride. My own thought processes are really just ways to soothe myself as the market does whatever it is going to do. In an up market, I will appreciate the growth in our portfolio balance. In a down market, I will appreciate getting deals.

Either way, I am not the catalyst for market change, but rather a witness of it. And, if all goes as planned, a beneficiary of it. My main job is to stay the course, which consists primarily of two actions:

- Keep buying regularly no matter what.

- Give the principal time to grow. In other words, invest for the long-term, leave it in there, and don’t touch it. No matter what!

So keep buying, and then hang on!