As I wrote last year, we bring our clothes to be dried (we have a washer at home) at the nearby laundromat. This usually has worked out quite well, especially since the only expenses are for drying (which for several years now has been paid for with recycling money, as I once noted here).

However, as of late the paid dryers at the laundromat have raised their prices: instead of buying 10 minutes of drying time, $0.25 now buys 8 minutes.

Ee-gads!

That’s a 25% increase in the price of doing laundry. Before, $1.00 paid for 40 minutes of drying. Now, it only pays for 32 minutes. To get the same 40 minutes, you need to put in $1.25 now. What was $1.00 is now $1.25, ergo a 25% increase in price.

Okay, so maybe this really isn’t a big deal (Although I did have a WTF? moment there when I realized it). However, the point is still there.

So, who put together a conspiracy to rob us of the value of our money, slowly over time (or sometimes not so slowly), so that what used to be one price is suddenly more expensive?

The short answer: it’s Inflation, man! The silent killer… of the value of your money. Recently, I wrote about the incredible long-term return of stocks. Even measured against inflation, stocks did very well. Yet observe this: since 1801, the price of living has multiplied almost 18 times. In other words, what cost $1 in 1801 now would cost $18 (I know… they didn’t have gas stations, internet providers, or Frappucinos in 1801, so it’s a bit hard to compare some expenses, but I think you can follow me on this).

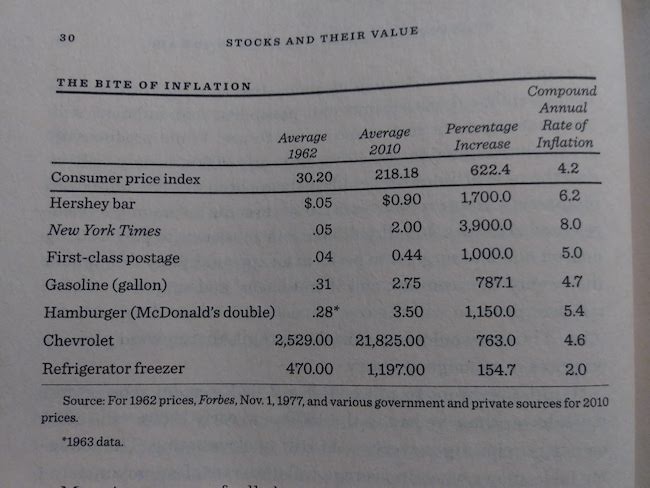

Also, witness the chart that is the featured image for this post (from “A Random Walk Down Wall Street,” p30). Over the forty-eight years from 1962 to 2010:

- the price of a Hershey bar changed from $0.05 to $0.90 (that’s 18 times more for a candy bar!)

- the cost of the New York Times went from $0.05 to $2.00 (that’s 40 times more!)

- A first class stamp went from $0.04 to $0.44 (that’s 11 times more)

- A gallon of gas went from $0.31 to $2.75 (that’s over 8 times more)

- A McDonald’s Hamburger went from $0.28 to $3.50 (about 12 times more)

- A Chevrolet went from $2,529 to $21,825 (nearly 9 times more)

- A refrigerator freezer went from $470 to $1,197 (or over 2 times more… only)

Inflation is real! I don’t think I fully understood it until the last few years, when I became a personal finance junkie (and read stuff like that chart). Before then, I imagined that somehow the past was just a quaint time where things were less expensive (As in, “Isn’t it quaint? People lived on $2000 a year etc.” or “Wow, that was back when a movie ticket cost $0.25!”). Now I know what is really going on: those folks in the past had money that was worth so much more than ours they just didn’t need as much!

This has huge implications for your nest egg. Because of the cumulative effects of inflation (if for no other reason!), one ought to invest one’s money where it will maintain its value over time… not simply it’s number amount, but it’s purchasing poower (instead of losing it to inflation).

I know, I know. Some people like to store their money in the mattress (whether figuratively, or literally). The problem with this: if you leave it in there, the money you take out of there will be worth less, maybe a lot less.

Much better to invest your money where it will have a chance to grow, perhaps much more than the rate of inflation (as stocks have done over the long-term).