A few weeks ago I wrote a post called “It’s Buying Season!” It’s not about shopping for gifts over the holidays, but about buying more index funds while the stock market is down. For the last three months of the year, the market experienced a steady and slippery drop. Yet I was delighting on the fact that the price of shares was lower. Hence, buying season!

When I shared my post on Facebook, I immediately got a response from several Facebook friends warning me about the market crashing and how I should think twice before investing in it. I found this sort of surprising (I mean, to get comments from MULTIPLE people on Facebook about one of my blog posts!), because it seems that my post caught the pulse of some of the fearful ideas floating around about investing.

While I’m not a mind reader, to me the comments those friends made were, while well-intended, frought with fear. They didn’t seem to understand the principles of buy and hold index fund investing, namely that, when you are invested for the long run, it is actually a good thing when the market is down, because that means prices go down. Which means, it’s a great time to buy!

When I was reading my friends’ comments, I had an eerie feeling of deja vu. These comments might have been made by me (or at least thought by me) a few years ago. I was confused and ignorant about what investing in the stock market meant. I didn’t even know what index funds were. And I certainly didn’t understand that a down market is actually a buying opportunity.

For the past month, I have been enjoying the perks of a lower-than-usual market: As I wrote in my previous post, I bought extra shares of one of my funds. Also, I recently got a yearly dividend from my funds, and these dividends were used to buy extra shares of those funds… at a discount! Plus, my usual monthly contributions also went a lot further to buy shares.

In fact, just a few days ago, I was looking at some of my stats on how many shares I have in one fund, and I noticed that the balance on the fund was the same as it had been exactly two months ago… but with almost 40 more shares! Yes, this is because the shares are worth that much less. However, I wouldn’t have bought almost 40 new shares (it was actually about 38) with the same money if the market had been up. I would have bought closer to 35.

I’ll take 3 extra new shares, even if the total current balance is down 🙂

Think about it: eventually, those shares are going to grow in value. That is the long-term expectation of the stock market. When you start looking out 10, 20, or 30 years, the chances are good that market values are going up. And not just a little bit up, but a lot up. And with my 3 extra shares which I essentially got as if “for free,” because the market went down, will grow with all the rest. The power of compounding interest is dynamite!

Now, 3 extra shares may not seem like a lot. It’s the principle that matters. Over time, my buying habits are compounding. They will reach a critical mass. Small changes, added up over time, become big changes!

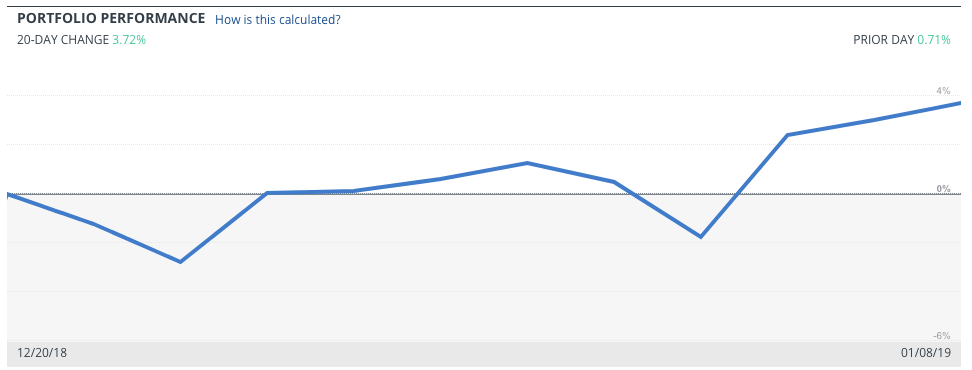

By the way, since I wrote the post that attracted the doom-and-gloom warnings, the market has gone up nearly 4%. While that’s no guarantee of what the future holds, it does go to show that a little down market does not mean the sky is falling. Who knows what tomorrow will bring? My investment strategy is looking out many years for now. I don’t mind some bad weather now and then. In fact, I’m prepared for it: I brought my galoshes.

And my wallet 😉