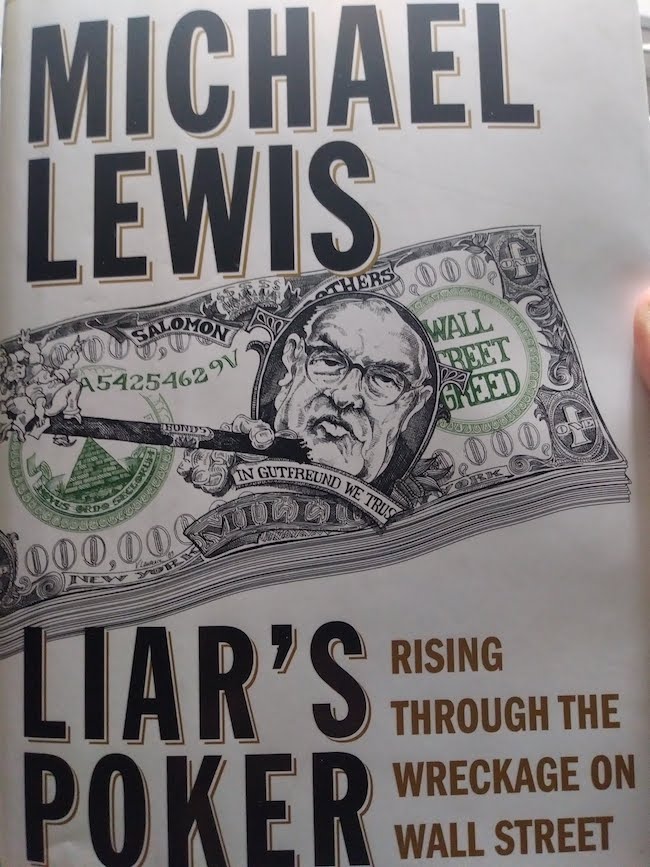

I just finished reading Michael Lewis’s Liar’s Poker: Rising through the Wreckage on Wall Street. If you have seen any of the following movies–The Big Short, The Blind Side, or Moneyball— well, these were all Michael Lewis books that became hit movies. Lewis is a former bond salesman for Solomon Brothers. Back in the 1980s, Liar’s Poker established his writing career as a whistle-blower of sorts, using his journalistic sensibility and keen storyteller’s instincts to help people peep behind-the-scenes into the world of large-scale corporate money-making. What we see there is as ghastly as it is fascinating.

Liar’s Poker may be the first book of Lewis’s that I’ve read, but I’ve been a fan for years. Of the movies created by from work, that is: I was intrigued by Moneyball, moved by The Blind Side, floored by The Big Short, and thoroughly enterained by all three. If you haven’t seen it, The Big Short is the movie that explains the 2008 financial crisis to us common people who– if you’re like me–lived through it, but never really understood what the hell happened. The Big Short feels like a big triumphant kick in the teeth to corporate greed and foolishness, as it gloriously tells the story of the prescient people who anticipated the crisis… and won big by betting against the housing market.

As my first read of the writer behind that movie, Liar’s Poker did not disappoint. It takes you smack dab into a similar world: 1980s Wall Street, where Solomon Brothers rules supreme. According to Lewis,

man for man Salmon Brothers was, in 1985, the world’s most profitable corporation. At least that is what I was repeatedly told. I never bothered to check it because it seemed so obviously true. Wall Street was hot. And we were Wall Street’s most profitable firm.

Liar’s Poker, p40

In reading the book, one quickly forms a picture of a world of unrestrained machismo and ruthless financial power plays that is both strangely mesmerizing and egregiously disturbing. Lewis portrays a place where greed has been empowered to the point of lawlessness. Lewis describes how it was put to him by one of his trainers:

‘The trading floor is a jungle,’ he went on, ‘and the guy you end up working for is your jungle leader. Whether you succeed here or not depends on knowing how to survive in the jungle.’

Liar’s Poker, p48

Startingly few moments of humanity speckle his description of life at Solomon Brothers. (If it helps, Solomon Brothers also was an inspiration for Tom Wolfe’s The Bonfire of the Vanities ). For example, here is a passage where Lewis describes the Solomon Brothers training program:

Life as a Solomon trainee was like being beaten up every day by the neighborhood bully. Eventually you grew mean and surly. The odds of making it into the Salmon training program, in spite of my own fluky good luck, had been 60:1 against. You beat those odds and you felt you deserved some relief. There wasn’t any. The firm never took you aside and rubbed you on the back to let you know that everything as going to be fine. Just the opposite, the firm built a system around the belief that trainees should wriggle and squirm. The winners of the Salmon interviewing process were pitted against one another in the classroom. In short, the baddest of the bad were competing for jobs.

Liar’s Poker, p87

Reading Lewis’ description of a corporate culture where high-flying wrongdoers could do no wrong reminded me of a documentary I watched awhile ago on Enron (which we all know also went down in flames because its culture of corruption). I admit, the power and money making has a somewhat intoxicating effect: like a hot plate of greasy food, I get how for some people it could be juicy and delicious. Yet for most of it seems hazardous to human health! You have to be able to endure daily emotional bludgeoning in an unforgiving meritocracy ruled by extremely aggressive, pumped up bond traders.

Lewis’ first-hand account is truly revelatory, and you can’t help but empathize with him:

“As a Salmon Brothers trainee, of course, you didn’t worry too much about ethics. You were just trying to stay alive. You felt flattered to be on the same team with the people who kicked everyone’s ass all the time. Like a kid mysteriously befriended by the schoolyard bully, you tended to overlook the flaws of bond people in exchange for their protection. I sat wide-eyed when these people came to speak to us and observed a behavioral smorgasbord the likes of which I had never before encountered, except in fiction. As a student you had to start from the premise that each of these characters was immensely successful, then try to figure out way.”

Liar’s Poker, p87

Ruthlessness, might-is-right aggression, and survival-of-the-merciless seem to dominate the Solomon Brothers corporate climate. This is no environment where people are encouraged to self-actualize! Instead, the “the Big Swinging Dicks” ruled the roost with crassness and aggression bordering on barbarism.

I was fascinated by Lewis’s account of his Solomon Brothers career, from trainee at the start of his career ultimately to becoming himself “a Big Swinging Dick.” At the same time, I was often perplexed at how he could have stomached such a thoroughly toxic environment. Several times Lewis refers to how he used innate-seeming street smarts to get ahead there. It seems that, in order to survive life in the dragon’s lair, he had to become a dragon too, at least to some extent. However, I appreciate that Lewis had this experience and “lived to tell about it,” so to speak. I love the bird’s eye view into a world I would never have entered otherwise. It reminds of several other well-written non-fiction accounts I read in the past few years: The Glass Castle, McDonald’s: Behind the Arches, and an excellent book about Yahoo! I read last year.

At times, I found reading Lair’s Poker quite disturbing–thinking of these hard-nosed assholes with their merciless pursuit of success and often brutal and cruel behavior toward each other. However, it was definitely a page turner. And from the beginning, Lewis foreshadows the eventual downfall of the company. It is implied in every act of hubris from page one to the very last. In a way, reading this is like watching one of those disaster movies where you know it’s only going to get worse but you can’t help but watch the car crash and the building burn down.

Overall, I found the book edifying, even heroic. I applaud the courage it took for Lewis to step out on a limb and write it, especially when he was so near to it (he published it in 1989, a year after he left Solomon Brothers). And I appreciate getting this unique perspective on the human experience from someone who survived a trip into the lion’s den.

I would gladly read more Michael Lewis, and there is much more to this book than I have talked about here. Ultimately, it is an account of a young man in his 20s getting a huge dose of “real world” education that seems to have helped shape his own personal values (and launch his writing career, of course). He may have cavorted with the dragons for awhile, but in the end, he wasn’t really one of them. He alludes to how he changed after his Solomon Brothers experience:

For me… the belief in the meaning of making dollars crumbled; the proposition that the more money you earn, the better the life you are leading was refuted by too much hard evidence to the contrary. And without that belief, I lost the need to make huge sums of money. The funny thing is that I was largely unaware how heavily influenced I was by the money belief until it vanished.

Liar’s Poker, p308

Personal note: It would seem that I have arisen out of my book-reading break, as I finished two books this week. Not that it matters to anyone reading this, but I give myself brownie points and a figurative pat on the back 🙂