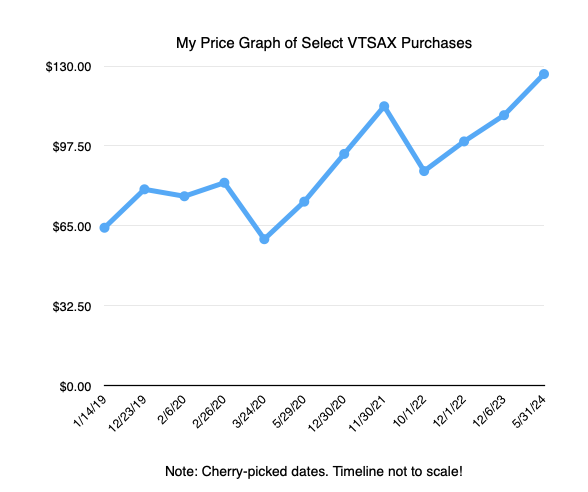

As I mentioned recently, for awhile now I have been a big fan of Vanguard’s Total US Stock Market Index Fund, or VTSAX. In fact, I have been buying shares of it since the beginning of 2019, so 5 1/2 years. Today I got the idea to sorta stroll down memory lane to see some key points in its price journey as I bought the fund.

To start with, the first time I bought VTSAX was on January 14, 2019. It was at $64.29, and I exchanged it for a target date fund I had been holding. I continued buying it all year, and for my final purchase of 2019, on December 23rd, it was at $79.90. That’s 24% price growth from my January purchase… not a bad start!*

That brings us to 2020. On February 6th, I bought VTSAX at $82.57 (By the way, this was the highest it had ever been). When the Pandemic hit, the fund fell quickly with the market. I “bought the dip” (see here), starting $77.08 on February 26th all the way down to $59.64 on March 24th. Throughout March, April, and May, I continued buying whenever I could.** On May 29th, I bought at $74.89, which incidentally was where the fund had been the previous October.*** My final purchase in 2020, on December 30th, was at $94.28, or 14% higher than my February 6th purchase (even with all the drama that went down that year… it was a much higher high than before the Pandemic).

2021 was a growth year without the drama of 2020. I kept buying. My final purchase of 2021, on November 30th, was at $116.71… or about 24% higher than my final purchase of 2020 (and over 40% higher than the high I bought at on February 6th, 2020).

So then 2022 happened. Interest rates started going up, and stocks and bonds tumbled. I bought throughout the year. The lowest price I bought at, on October 1st, was $87.31, nearly $30 (or about 25%) lower than the price the previous November.

Of course, soon after this we started climbing out of the bear market. My final purchase of 2022, on December 1st, was at $99.35. Last year was more or less a steady climb upward, with a few bumps. My final purchase of 2023, on December 6th, was at $110.01. This was about 11% higher than my final 2022 purchase but still lower than the highs of 2021.

Then we have a roaring 2024 year so far. My last purchase of VTSAX, on May 31st, was at $126.73. Of course, this was a new high. Incidentally, this also is 97% higher than my first purchase of VTSAX back in January 2019.

What’s the upshot here? As you can see in the graph above, it’s been a wild ride over the past 5 1/2 years, with many twists and turns. Of course, I cherry-picked a few specific dates that serve my narrative. The bottom line: despite the drama, the fund has doubled.

Not bad!

*Disclaimer: This post is not meant as a definitive report on VTSAX’s annual performance in 2019 or any year. It is more a subjective narrative of how my purchases compared over time 🙂

**You could say this was a silver lining from the tumult at the beginning of the Pandemic.

***Just like that, a massive bear market came and went.